The Remote CFO’s Guide to Closing the Books from Home

The coronavirus crisis is a stress test for businesses across every industry and in every geography. In a very short period of time, it has changed the way we do business. What hasn’t changed because of COVID-19? The accounting calendar, for one.

CFOs are still expected to close the books at the end of each month and begin preparing for the quarter-end close, but operating with a remote workforce presents some unique challenges. Finance teams around the world are closing the books from home. For most of them, that’s uncharted territory. Here are some best practices for getting the job done:

1. Set clear expectations with the C-suite.

Begin by having a frank conversation with your executive team. To avoid surprises, let them know that the process will be different this time, and that closing may be delayed. The quarter-end process typically requires certain tasks to be performed on-site. In the current situation, those things might take longer, and some steps might not even be possible at all. Because your customers and vendors are also experiencing disruption, it may be a challenge to get the information you need from them. It is important that members of your company’s executive team understand this so that they can plan accordingly. Set expectations and let your C-level team know how they can support you.

2. Communicate daily.

Times of rapid change call for frequent communication with your entire team and key stakeholders. Management guru Verne Harnish advises leaders to send out daily communication, even if it is very short. He recommends an email or a short 2-minute video. Be clear, concise, and factual. As you make your plan for dealing with unexpected change, be sure that everyone in your organization is aware of what you’re doing and how they fit into the process.

3. Review your closing checklist.

Get your finance team together to review your list. What resources do you need to close the books in terms of time, staff input, data, and technology? How has your access to those resources been impacted by working remotely? To avoid setbacks and mistakes, you need to coordinate resources and responsibilities by delegating tasks, creating schedules, modifying workflows, and communicating information. With deadlines looming, it’s tempting to charge forward without a clear course of action. However, now more than ever, CFOs need to be on the exact same page as their team.

A Better Way to Conduct Month End

View Guide NowWhat are the tasks that need to get done every time you close the books? Determine which of those items previously required a physical presence at the office, and look for alternatives that can help you get the job done. Identify outside parties whose input you require, and determine whether you can rely on a timely response from them. Look through your entire checklist and identify potential weak points. The experts at Ernst & Young recommend setting up a virtual command center to review your closing checklist and plan the appropriate response. EY has created a checklist of questions that CFOs should consider when doing a remote close.

4. Plan for potential problems.

A flash CFO survey showed that 60 percent expect productivity to decrease in the coming months because of working remotely. Even with careful coordination, staff members are likely to fall sick, become unmotivated, or have family issues with which to contend. Layoffs might also become necessary at some point, which can further compromise team dynamics. Beyond closing the office, COVID-19 creates extensive and unexpected obstacles for CFOs trying to preserve the status quo, from diminished productivity to inaccessible data. Therefore, don’t expect what works at first to work continuously.

5. Evaluate your risk exposure.

With the onset of the coronavirus, a lot has changed. Businesses are holding onto cash and trimming expenses. That means that your customers might be slower to pay you. Accounts that were previously predictable might now be harder to predict. Should your allowance for doubtful accounts change? What will happen to cash flow? What about sales? Is your supply chain still dependable? Do you have contracts with MAC clauses that could be triggered by recent events? Are you carrying goodwill on the books that may be impaired? The situation calls for a closer look at many of the things that you usually take for granted. These may be material, and it’s important that you address these risks now.

6. Prioritize appropriately.

Consider rolling out a triage system for account reconciliations. Focus on the accounts that have material significance, such as cash, accounts receivable, payables, and loans. Although a comprehensive process is always preferred, it may be necessary to focus on the numbers that matter most. If the reconciliation of non-key accounts can be delayed, put them at the bottom of your priority list. Document any deviations from your standard procedures and make plans to address those before your next closing.

This close cycle will look drastically different than the previous one. The pandemic will affect revenues and cost of goods, as well as subject new assets to impairment. It will also trigger new reporting requirements and expose companies to uncomfortable levels of volatility. Conducting a normal close in the coming months will be hard enough, but that process will now also require new kinds of data and deeper levels of analysis, along with more input and attention from the entire F&A team. As CFOs figure out how to adapt to the moment, they must adjust their financial priorities along with their workflows.

7. Make your requests for information ASAP.

You already know that you will need information from outside of your team, from within your company, and from external parties. Some of that, such as a bank statement, may be available on a self-service basis. Other information may be delayed in getting to you. If you rely on other departments, subsidiaries, or outside vendors to provide those details, be sure to make your request early and plan for possible delays. Compile a list of the statements, balances, inventory counts, and anything else you typically need to close the books. For anything that’s not self-service, put in your request right away, and follow up quickly if you don’t get what you need.

8. Go digital wherever possible.

Certain tasks simply can’t be done without a physical presence. It’s hard to imagine doing a physical inventory count without being in the same place as your inventory. However, there are many things that can be digitized. If your company is currently using a physical sign-off process, look for ways to move that online with digital signatures or email. Paper documents can be scanned and shared digitally. Collaboration-based reporting tools enable your team to access the information they need without relying on the IT department. Look for any opportunities to take your processes online.

9. Reassess areas of judgment.

Above all, be prepared to adjust the course. A recent PwC poll of CFOs showed a dramatic change in business sentiment over a period of just two weeks. Things have changed quickly, and the companies that survive and thrive will be the ones that adapt rapidly. Market changes will likely require reconsideration of accruals, reserves, and more at quarter-end. For example, if collections are expected to extend, CFOs may need to adjust the general Accounts Receivable reserve calculations so as not to overstate the reserve against Accounts Receivable if it is viewed as a temporary payment delay versus a collectability risk.

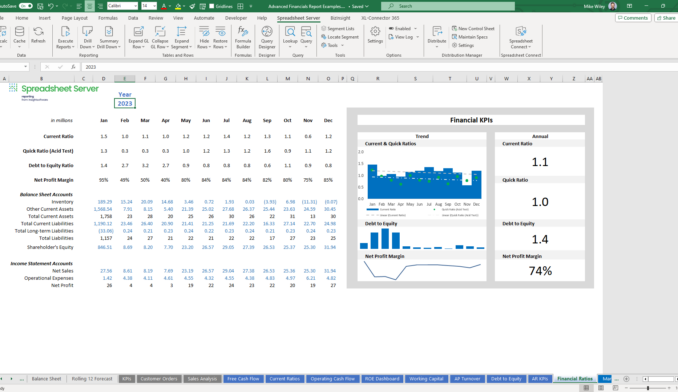

CFOs should look to real-time reporting tools that can be rolled out quickly to empower end-users with the information they need to drive reassessment. When the finance team can pull up-to-the-minute information directly from the ERP system (or any other software your company is using), they can get answers quickly without depending on the IT department. Companies that have real-time visibility and strong analysis tools are better equipped to respond to events as they happen.

10. Learn as you go.

There’s no precedent for what’s happening right now. Even full-time remote CFOs are having to adapt on the fly. Every team will need to figure out a way to get through the next month-end close and quarter-end close, but no one should expect those processes to be perfect. They should evolve continually based on honest evaluation and team feedback. Some form of business disruption looks likely to persist for months, and even when teams return to the office, it is unlikely that normal operations will resume immediately.

11. Let insightsoftware help.

More than ever before, a decentralized finance workforce needs tools that support quick access, self-service, and powerful features that give them visibility to data from across the enterprise. Reporting solutions from insightsoftware can be rolled out quickly, without extensive help from IT specialists. Remote users can get up and running with a simple installation, giving them access to robust reporting, analysis, and forecasting tools.

To access more information about how to maintain business continuity during the COVID-19 crisis, visit our COVID-19 Resource Page.