COVID-19 Financial Crisis: Frequently Asked Questions Answered

How do you conduct business as usual in the midst of unprecedented events? That’s the question being asked in accounting departments across the country as the effects of the COVID-19 pandemic start to impact the global economy in sweeping ways.

Finance teams face twin challenges. First, they must meet ordinary obligations while working outside of the office and disconnected from coworkers. Second, they must do everything possible to understand how unpredictable economic forces will affect financial performance moving forward.

Not surprisingly, CFOs and accounting executives have a lot of urgent questions right now. While there aren’t any easy answers, decision-makers can follow best practices for learned wisdom. Discover how that applies to your own business by exploring some of the most common questions finance teams are seeking to answer today, along with the advice we recommend.

Sales Scenario Planning

What if some customers decide to delay buying decisions 30, 60, or even 90 days?

In the wake of nationwide economic shut-downs, many companies are watching and waiting. From that cautious position, they’re unlikely to move forward with buying decisions no matter how enthusiastic they appeared before or how many incentives you’re able to offer. Unless you operate in a few privileged industries, you will likely contend with declining revenues this quarter and next, making it incumbent on the accounting team to adjust plans and forecasts accordingly. Having access to up-to-date data to understand the depth of those declines and their enterprise-wide impact will be crucial. This is particularly true for establishing triggering events that spur accountants into action early enough to have a positive impact.

What if some customers choose to not buy at all, focusing resources on other areas of the business?

Faced with the prospect of diminished revenue for several months, accounting departments need to prepare for a new paradigm. For all intents and purposes, every plan for 2020 needs to be re-evaluated and likely heavily revised. Those plans must account for lost revenue in the short-term, lost productivity due to remote/absent workers, and perilous sales conditions into the foreseeable future. Exploring all these unknowns becomes significantly easier with scenario planning capabilities that allow companies to model conditions and forecast financial health based on changing customer behavior and how long the the economy takes to recover. At a time like this when so much feels out of a company’s control, planning and preparation are invaluable assets.

Cash Flow Planning

What if some customers want to hold on to cash, being unsure of their near term revenue/receipts?

With over 82 percent of executives in one recent survey predicting revenue declines, companies should anticipate having less cash on hand and create a 13-week plan in response. Use this plan to stress test the organization, identifying when, where, why, and how diminished cash could jeopardize the company’s plans and obligations. Then make every effort to collect debts, possibly by offering discounts for early or cash payments. On the other end of the spectrum, insulate your company from cash flow issues by exploring if you can delay payments or renegotiate terms with vendors. Finally, cushion the company’s liquidity by exploring low-interest small business loans and other relief programs offered through the governments of many countries.

What if our vendors require quicker or upfront payments before delivering goods or services?

The present moment requires two key traits: diplomacy and adaptability. As vendors grapple with their own cash flow issues, they may request or even require quicker payments before delivering essential goods and services. Your first response should be to negotiate. For reasons you can also understand, most companies would rather preserve a customer relationship on different terms than lose that customer right before an economic downturn. However, there are limits to negotiations, and when you’re forced to pay sooner while cash flow is also tight, you’ll need to tread a fine line in balancing cash inflow and outflow.

Expense planning

If my workforce is going to be remote for 30-45 days, what does that mean for expense categories such as IT requirements or mobile/internet reimbursements?

Indefinitely shuttering the office means that some or most of the IT your company pays for is sitting idle. Investigate the possibility of canceling subscriptions or scaling back costs to free up some cash, but beware of trimming IT expenses too much and leaving the company in a compromised position either now or when things return to normal. You should also be preparing for new costs in the form of remote worker reimbursements. In most cases, laws require employers to facilitate remote work by paying for mobile and/or internet access. With effective oversight and management, you can offset IT cost increases with cost reductions without compromising service.

How will the company’s travel budget be impacted by internal vs. external meetings?

If there is any silver lining to this situation, it’s that your travel budget will likely be a lot larger than expected at the end of the year. Those extra funds can alleviate losses in other areas, but they can’t close every hole on the balance sheet. Before touching any of this money, consider how much travel will be possible or necessary in the coming months, because some money must still be available. Budget for the cost of “virtual travel” as well. Meetings originally planned to happen in-person could take place over video conferencing, but that may involve paying for an enterprise-class conferencing service or bolstering the underlying IT infrastructure. Adaptable companies will find ways to repurpose unneeded travel budgets, but prudent companies won’t rush to fleece those funds.

Should we suspend hiring, and can we base hiring decisions on video interviews?

This relates to the much larger question of whether to scale back, hold steady, or push forward with growth plans. After years of low unemployment rates, many companies are desperate for talent and can’t miss the opportunity to bring someone impressive on board because of (hopefully) short-term setbacks. At the same time, recruiting creates huge costs, and with so much up in the air, who knows what staffing needs will look like in six months? Even when companies must absolutely hire, confidently selecting candidates without meeting them in person risks a hiring mistake, further hurting the company. In terms of hiring specifically and long-term planning specifically, don’t proceed with anything without recontextualizing everything. Now’s the time to be updating models, assumptions, and key indicators based on the changes that have already happened, and forecasting based on positive and negative hypotheticals. If hiring (or any large-scale expenditure) makes sense, the data and financial reports will prove it.

Are your reports up to the task?

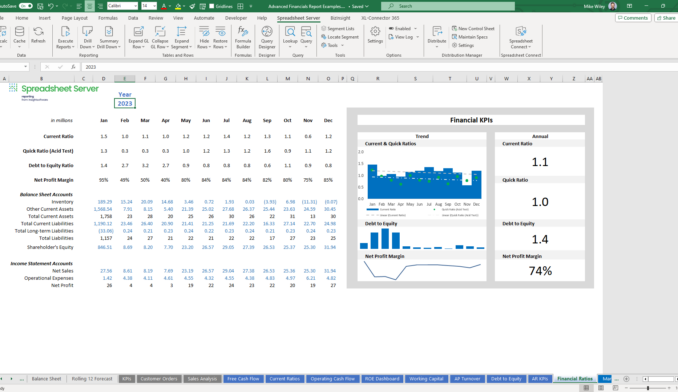

Now more than any time in recent history, CFOs and the accountants they lead need quality insights free of errors and omissions and available on-demand. Answering the questions above—and countless others—depends entirely on leveraging data as effectively as possible, and yet the manual reporting processes many companies rely on take too long and invite too many inconsistencies to meet this moment.

But there’s good news: Purpose-built financial reporting tools can not only connect a finance team that’s now adjusting to working outside the office, but also promote easy access to real-time data so you can be prepared for today’s reality and tomorrow’s uncertainty. Let us help you find a solution that fits your needs and works with your available resources. Contact us today.

Be Ready to Answer Any Finance Question Thrown at You