Financial Close & Consolidation Solutions

Boost your financial performance with accurate, compliant, and transparent close and consolidation.

„*“ zeigt erforderliche Felder an

Capabilities

Automate and Accelerate Your Financial Close and Consolidation Process with Confidence

If you are a finance professional who is responsible for closing the books and reporting the financial results of your organization, you know how challenging and time-consuming this process can be. You have to deal with multiple data sources, complex accounting rules, manual reconciliations, intercompany eliminations, currency translations, audit requirements, and more.

You need a solution to automate and accelerate your financial close and consolidation process while ensuring accuracy, compliance, and transparency. A solution that can handle any type of consolidation scenario, from simple to complex, and provide you with real-time visibility into your financial performance.

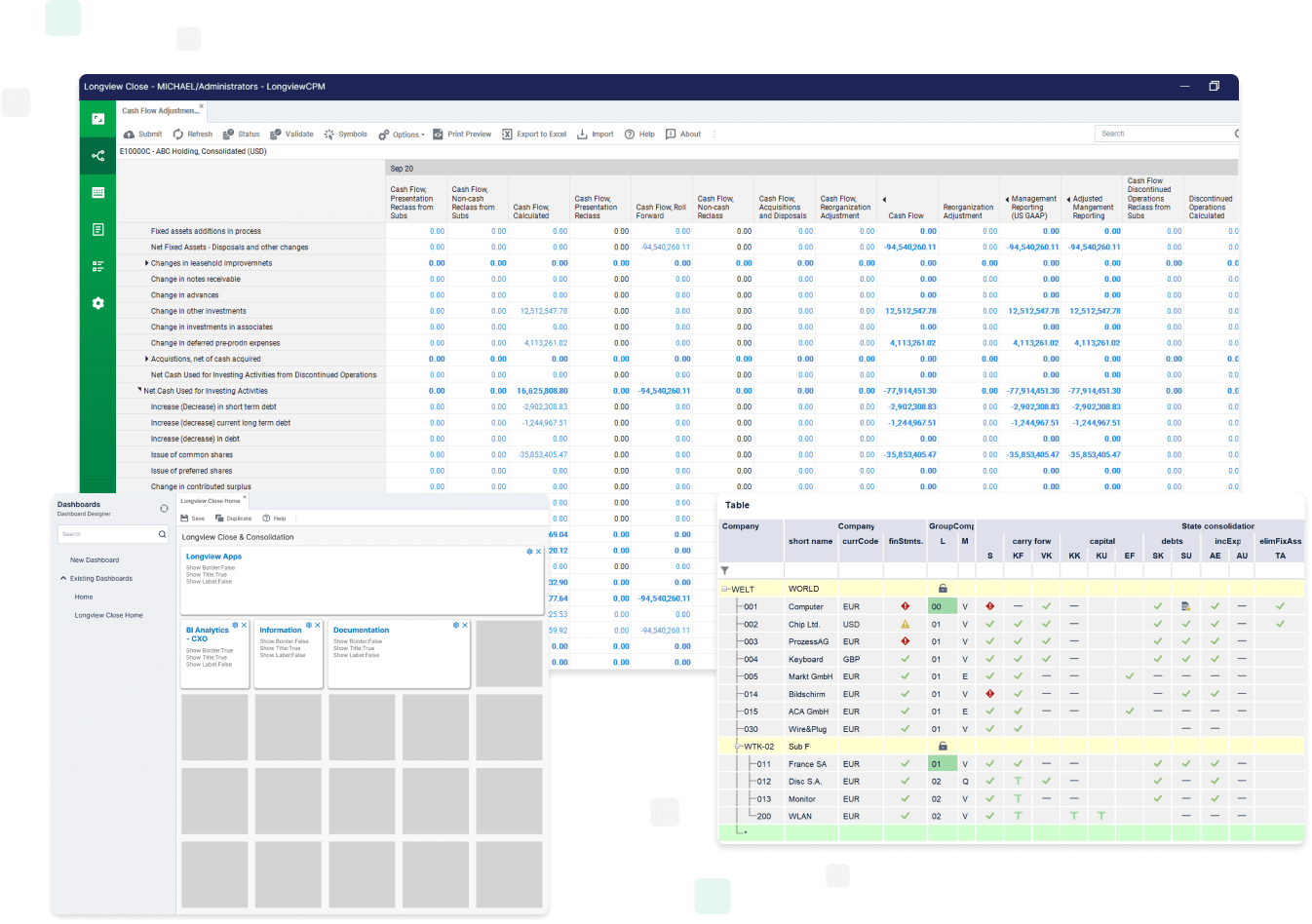

- Flexible Financial Consolidation

- Customizable Dashboards

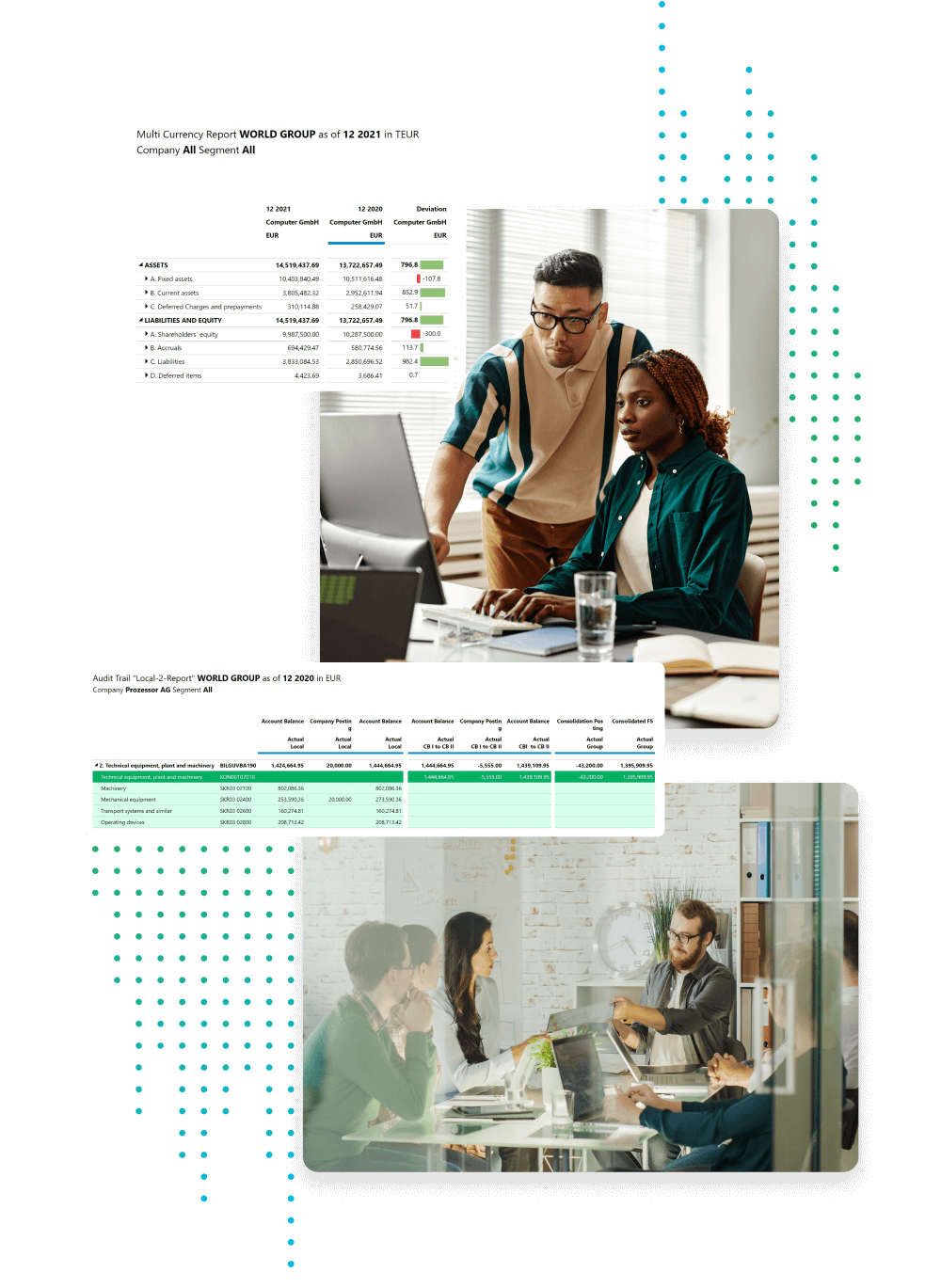

- Comprehensive Audit Trail

- Seamless Data Integration

- Real-Time Currency Conversion

- Automated Account Reconciliation

- Real-time Intercompany Eliminations

- Automated Data Collection

- Accounting Standards Compliance

- Scalability

Use Cases

For Financial Close & Consolidation Software

Financial close and consolidation software can help you address various use cases that are relevant to your business needs and goals.

One of the most common goals of finance professionals is to reduce the time it takes to close the books and report the financial results. A faster close cycle can improve efficiency, accuracy, timeliness, and confidence in your financial data. It can also free up more time for analysis and decision-making.

To achieve a faster close cycle, you need a solution that automates and streamlines your data collection, consolidation, reconciliation, and reporting processes. A solution that eliminates manual tasks, errors, and bottlenecks. A solution that gives you real-time visibility into your financial performance.

A common challenge facing finance professionals is managing complex consolidation scenarios that involve multiple entities, currencies, accounting standards, and business rules. For example, you may have to consolidate subsidiaries with different fiscal years or reporting currencies. Or you may have to apply different consolidation methods or ownership percentages depending on the type of entity or transaction.

To manage complex consolidation scenarios, you need a solution that can handle any type of consolidation logic and configuration. A solution that can adapt to changing business requirements and regulations. A solution that can provide you with consistent and reliable consolidated financial statements.

Finance professionals frequently need to gain insight into their financial performance across different dimensions, such as entities, products, markets, customers, or projects. This can help them understand the drivers of their profitability, growth, cash flow, or risk. It can also help them identify opportunities for improvement, optimization, or innovation.

To gain insight into your financial performance, you need a solution that can provide you with comprehensive and flexible reporting and analysis tools. A solution that can enable you to slice and dice your financial data by any dimension or attribute. A solution that can deliver actionable insights for your business.

Produkte

Ensure Accuracy and Eliminate Error Prone Processes

Roles & Industries

Making Use of Financial Close & Consolidation Software

Financial close and consolidation software is used by various roles across the finance function within the group function and across subsidiary companies.

Financial Controller

A financial controller oversees the accounting operations of an organization. They ensure that a company’s financial records are accurate, complete, and compliant with internal policies and external regulations. They also manage the financial close process, including data collection, consolidation, reconciliation, reporting, and analysis.

Financial close and consolidation software can help a financial controller to:

- Automate and streamline the financial close process, reducing errors, risks, and costs

- Ensure compliance with various accounting standards such as IFRS or US GAAP

- Provide timely, accurate, and consistent financial statements to internal stakeholders such as management or the board of directors

- Gain insight into the organization’s financial performance across different dimensions such as entities, products, regions, or projects

Financial Analyst

A financial analyst is responsible for analyzing the financial data of an organization. They use various tools, techniques, models, financial ratios, metrics, and benchmarks to evaluate the profitability, growth, cash flow, risk, etc., of the organization. They are also responsible for developing forecasts, building multiple scenarios, and providing recommendations to support and guide decision-making.

Financial close and consolidation software can help a financial analyst to:

- Access reliable, up-to-date, consolidated financial data from various sources

- Create and customize reports and dashboards using various formats and visualizations

- Explore the details behind any number or metric by drilling down or drilling through to the source data

- Perform what-if analysis and share the results with management and other stakeholders

FAQs

A cloud-based solution can offer several benefits, such as lower upfront costs, faster implementation, scalability, security, accessibility, and automatic updates.

You can ensure the security of your financial data in the cloud by choosing a reputable vendor that follows industry best practices and standards for data encryption, backup, recovery, authentication, authorization, and monitoring.

Ensure the vendor you choose to work with offers seamless integration that can easily connect to your primary data sources, such as ERP systems, spreadsheets, databases, or cloud applications, and that they are able to extract, transform and load this data into their software platform.

Choose close and consolidation software that is designed to be owned and managed by the finance team. Look for software that enables you to easily adapt workflows and templates to support data collection, validation, consolidation, and reporting, without needing IT or specialist help. Check that you can easily modify rules and validations to ensure the consistency and quality of your data.